Understanding Marital Property Division: A Complete Guide

Marital property division is a critical aspect of divorce proceedings. At Law Offices of Jeffrey A. Thompson, we understand the complexities and emotional challenges involved in this process.

This guide aims to provide a comprehensive overview of marital property division, including its definition, factors considered, and methods of distribution. We’ll explore the key elements that can impact the outcome of property division during a divorce.

What Is Marital Property?

Definition of Marital Property

Marital property encompasses all assets and debts acquired during a marriage, regardless of which spouse holds the title. At Law Offices of Jeffrey A. Thompson, we understand the importance of this concept in Massachusetts divorce proceedings. This broad category includes real estate, vehicles, retirement accounts, and business interests. Separate property includes all income, property, and assets that were acquired before the marriage. However, if these assets increased in value during the marriage due to either spouse’s efforts, they may be considered marital property.

Marital vs. Separate Property

Separate property typically includes assets owned before marriage, inheritances received by one spouse during marriage, and gifts given specifically to one individual. However, separate property can transform into marital property if it mixes with marital assets or if both spouses contribute to its maintenance or growth.

Common Examples of Marital Property

To illustrate, here are typical examples of marital property:

- Family home purchased after marriage

- Vehicles acquired post-wedding

- Joint bank accounts and investments

- Retirement benefits earned during marriage

- Businesses started or expanded while married

- Furniture and household items

- Pets acquired as a couple

It’s important to note that marital property also includes debts incurred during the marriage (e.g., credit card balances, mortgages, and personal loans).

Complexity in Property Classification

The classification of property as marital or separate isn’t always clear-cut. Consider these scenarios:

-

A house owned by one spouse before marriage: If marital funds paid the mortgage or funded improvements, a portion of the home’s value might become marital property.

-

A separate business: If it grew significantly during marriage due to direct or indirect contributions from the other spouse, the increase in value might be treated as marital property.

Impact on Divorce Proceedings

Understanding the distinction between marital and separate property proves essential in divorce cases. It affects how assets and debts are divided, which can significantly impact both parties’ financial futures. The classification of property often becomes a point of contention, requiring careful examination of financial records and sometimes expert valuation.

As we move forward, we’ll explore the factors that courts consider when dividing marital property, providing insight into how these classifications can affect the outcome of your divorce settlement.

How Courts Divide Marital Property

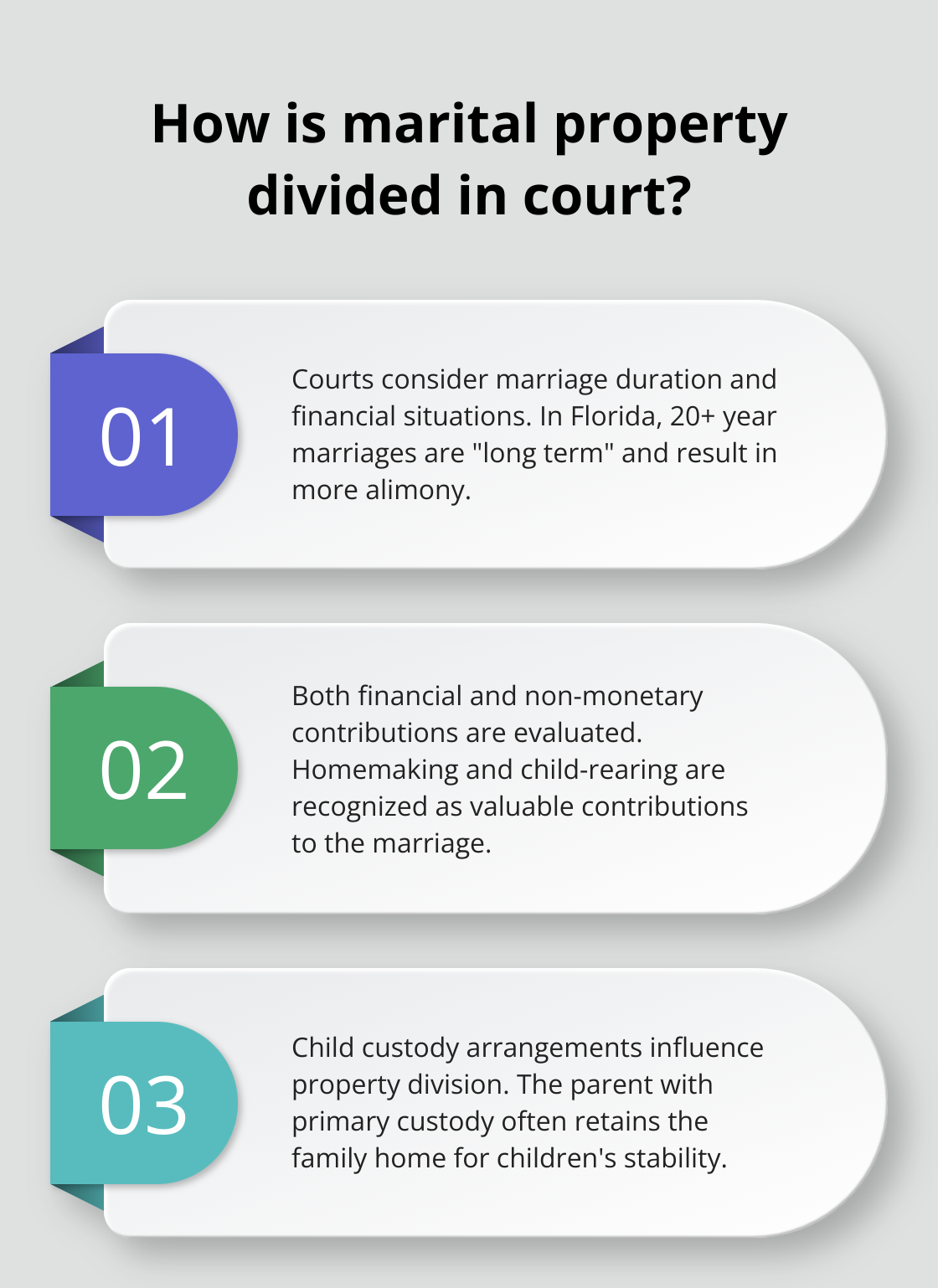

Length of Marriage and Financial Situations

Courts consider the duration of a marriage when dividing marital property. In Florida, a 20+ year marriage is considered “long term” and will result in a greater amount of alimony. Courts examine each spouse’s current financial standing, including income, earning potential, and separate assets. This assessment helps determine if one spouse requires additional support post-divorce.

Contributions to the Marriage

Courts evaluate both financial and non-monetary contributions. They recognize the value of homemaking and child-rearing. For example, if one spouse sacrificed their career to raise children, courts may award them a larger share of marital assets to compensate for lost earning potential. Business owners should note that their spouse’s indirect contributions to the business’s success (such as managing the household) can impact property division.

Impact of Child Custody on Property Division

Child custody arrangements influence property division decisions. The parent with primary custody often retains the family home to maintain stability for the children. This doesn’t mean the other parent loses out; instead, they might receive other assets of equivalent value. It’s important to consider the long-term financial implications of keeping the family home, including maintenance costs and potential tax consequences.

Tax Implications of Property Division

The tax consequences of property division can be substantial and often overlooked. For example, selling a house might trigger capital gains tax, while transferring retirement accounts could incur penalties if not done correctly. We advise clients to consult with a tax professional to understand the full implications of their property division agreement.

Equitable Distribution in Massachusetts

Massachusetts follows equitable distribution laws, which means property isn’t necessarily split 50/50. Instead, the court tries to achieve a fair division based on the specific circumstances of each case. This approach applies specifically to marital assets, which may include bank and investment accounts. This allows for flexibility but can also lead to unpredictable outcomes without proper legal guidance.

As we move forward, we’ll explore the various methods used to divide marital property, including negotiation, mediation, and litigation. Understanding these options will help you make informed decisions about your property division process.

Methods of Marital Property Division

Negotiation and Settlement

Most divorcing couples prefer to negotiate property division outside of court. This approach offers more control over the outcome and can reduce costs and time compared to litigation. During negotiations, spouses and their attorneys collaborate to create a mutually agreeable settlement. This process often involves compromise, with each party prioritizing their most important assets.

Thorough preparation, including a comprehensive inventory of assets and debts, can significantly streamline this process. Couples who choose this method often find it less stressful and more satisfactory than court-ordered division.

Mediation as an Alternative

Mediation has gained popularity as an alternative to traditional litigation. In this process, a neutral third party helps facilitate discussions between spouses to reach an agreement. Mediation can be particularly effective for couples who want to maintain an amicable relationship (especially when children are involved).

Divorce mediation in Massachusetts is a process where couples work with a neutral mediator to resolve issues related to their divorce, including property division, child custody, and support.

Litigation and Court-Ordered Division

When negotiations and mediation fail, the court decides about property division. In Massachusetts, judges consider several factors when dividing marital property, including:

- The length of the marriage

- The age and health of both parties

- The income and earning potential of each spouse

- Contributions to the acquisition of marital property

- The needs of any dependent children

Court-ordered division can be unpredictable and often leaves both parties dissatisfied. The American Academy of Matrimonial Lawyers has conducted numerous legal malpractice surveys and published findings related to divorce proceedings.

The Impact of State Laws

Massachusetts follows equitable distribution principles, but other states may have different approaches. For instance, community property states like California and Texas generally split marital assets 50/50, regardless of individual circumstances.

Understanding these differences is important, especially for couples who have lived in multiple states during their marriage or own property in different jurisdictions. Proper legal representation can help navigate these complexities and ensure that property division aligns with applicable state laws.

Final Thoughts

Marital property division during divorce presents complex challenges with lasting financial implications. Professional legal counsel proves invaluable in this process. An experienced attorney can guide you through state-specific laws, help identify and value marital assets, and advocate for your interests throughout the proceedings.

We at Law Offices of Jeffrey A. Thompson specialize in family law matters, including marital property division. Our team understands the nuances of Massachusetts law and how it applies to your unique situation. We provide expert guidance through every step of the divorce process, from initial property classification to final settlement negotiations or court proceedings.

Knowledge empowers you to make decisions that align with your long-term interests in marital property division. With the right legal support, you can navigate this challenging process with confidence. Our goal is to ensure a fair division of assets while protecting your financial future (and setting the stage for your post-divorce life).